Investment Strategy

Our investment strategy makes us unique; our results make us stand out.

Sector specialists

We are wholly dedicated to our six distinct sectors of focus.

Thematically driven

Proactive execution around identified trends within subsectors.

Proactive execution

Our subject matter expertise allows us to move quickly.

Operational strength

Well defined integration process, commercial operating system and management development program with subject matter experts to help you professionalize your business.

Partner with sector leaders

We partner with blue chip management teams of great businesses.

Buy and build investors

Seek to grow companies through organic growth and targeted M&A.

Investment Criteria

Locations

North America

Enterprise Value

$20mm – $500mm, no minimum for add-ons

Transaction Type

- Buyouts

- Corporate Carve Outs

- Recapitalizations

Sectors

- Transportation

- Power & Utilities

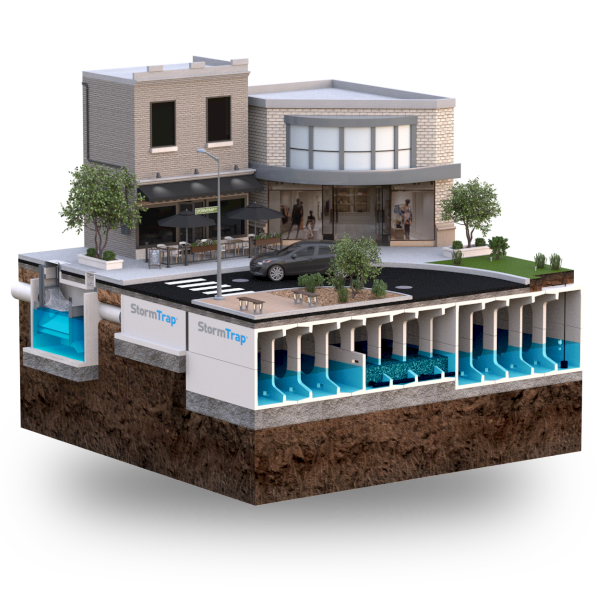

- Buildings & Facilities

- Digital Infrastructure

- Water & Wastewater

- Waste

Business Models

- Industrial Services

- Industrial Products

- Business Services and Technology

- Distribution